The rise of neo-banking and its role in the care of the underground population

The rise of neo-banking and its role in the care of the underground population

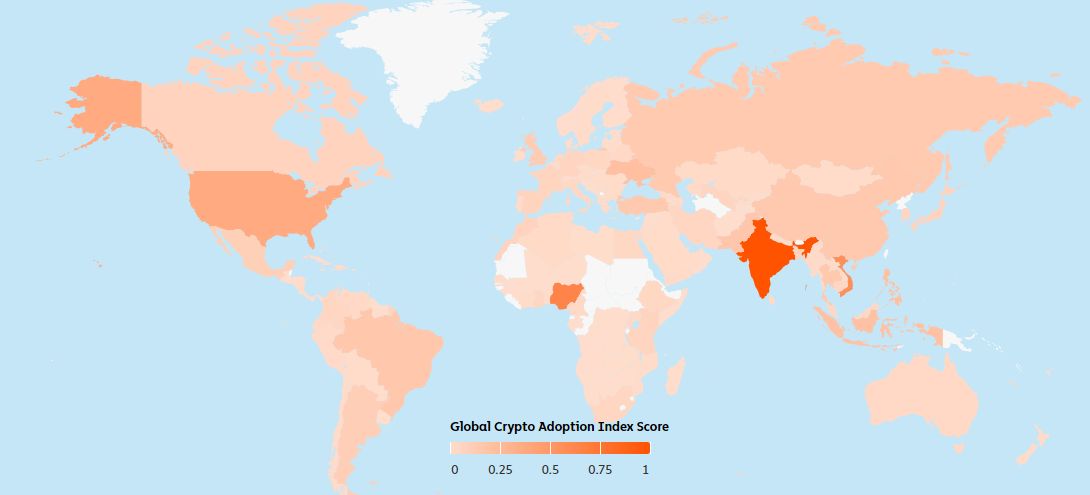

emerging countries are the fastest growing regions in the introduction of cryptocurrencies, and the growing presence of Neobanken plays the biggest role in this growth. Could these innovative platforms be the solution to financial inequalities and the lack of adequate banking services for over a billion people?

As Satoshi once noticed in his now established social media messages: "Bitcoin would be practically for people who do not have a credit card or do not want to use their cards." Emerging countries in Africa, Latin America or Southeast Asia could agree to this statement than others. In the past half decade, the growth of the Neobanks in developing countries has led to a revolutionary change in the way in which the population participates in their economies and to a radical change in their financial systems.

It is crucial that the billions of people are finally integrated into global financial systems without or with only limited access to banking services, although there is a lack of efficient bank structures in their respective countries.

This article explains how cryptocurrencies benefit people without (or with only limited) access to banking services and what role Neobanken play when providing financial services for countries that have little hope of stable bank infrastructure. The article also deals with the role of developing countries in the growth of the crypto ecosystem and various technological advances in the industry as a result of the rapid introduction to Subsahara Africa, Latin America and Southeast Asia.

financial inequality in under-provisioned economies

according to the World Bank report over 1.2 billion people worldwide have no or only insufficient access to Bank services. . Developing countries are still most affected: Over 50 % of the population have little or no access to a solid bank infrastructure or basic financial services such as loans, savings accounts, etc.

The advent of blockchain technology and cryptocurrencies triggered drastic change in the global financial system and provided the citizens of these countries previously not available. The emergence of this decentralized industry becomes a force in the global financial landscape and redesigned traditional currencies, transactions and financial systems.

cryptocurrencies based on blockchain technology and cryptographic principles open the financial world and enable citizens who have so far had no or only inadequate access to bank services to take part in the financial ecosystem. These assets have opened new options for transactions and value storage by enabling any access to fast and inexpensive digital cash that can be spent anywhere.

The rise of the new and decentralized financial system (defi)

The global financial crisis 2008 produced several innovations in the industry, especially the growth of neo-banking. NEO banks are financial technology companies that redefine the provision of banking services for consumers, from seamless digital experiences to lower transaction fees and accessibility via smartphones etc.

The best-known form of neo-banking was created in Kenya with the introduction of M-Pesa, a mobile phone-based financial service with which everyone could send and receive money with a SIM card and a phone. Over the years, such innovations have developed into impressive actors in the financial sector because they revolutionize traditional banking and finance.

Lately, apps for decentralized finance (Defi) have recently come to the fore. They offer digital and decentralized alternatives with personalized, user -centered services that are well received by crypto -savvy consumers. Regardless of this, apps for crypto exchanges are quickly shot out of the ground like mushrooms and offer everyone in the world the opportunity to access cryptocurrencies directly on their smartphone. These apps ensure extended security measures and seamless integration of fintech solutions, which means that they stand out from conventional financial services.

In this way, the industrialized countries were able to join the global financial systems, which means a paradigm shift in the transformative power of cryptocurrencies for modern consumers.

crypto exchanges could question the status quo

As already indicated, diversify crypto exchange on broader markets, develop the traditional financial system from simple on and off-ramping business models-global, inexpensive and very accessible to people without a bank account. The acceptance of cryptocurrencies is becoming increasingly clearer for the 1.2 billion and financial services and products become more demanding and more accessible. Could this be a threat to the traditional banking systems?

The court is not yet clear about this, but the solutions of these "decentralized new nans" have a major impact on the economies of the emerging countries-financial inclusion, low transfer fees and quick and secure transactions have promoted the growth of cryptocurrencies in these economies.

The platform also presents its spiritual child PIP World, a service that aims to strengthen users through edutech programs, playful trade and AI-supported gaming. pip dealer To form users, teams, compete against each other in commercial games and earn rewards in a AI-supported game.

outlook

The crypto report 2023 by chainalysis Style = "Font-Weight: 400;"> showed that over 40 % of the global cryptocurrency users live in countries with low to medium income (LMICS), the number grows every year. This impressive growth is strongly influenced by CEXs and the extensive services that you offer. Regulated regulated crypta borns could be the main driver for continuing acceptance rates by enabling neoobanking services for under-sized people.

The introduction of cryptocurrencies in emerging countries offers a unique opportunity to strengthen individuals, improve skills and financial skills and to find solutions for financial inequalities. In order for the industry to really grow, however, several things have to be implemented, including the establishment of secure platforms, compliance with legal regulations, the protection of user funds, easily accessible platforms and the clarification of the masses through technology.

Source: Coinlist.me

Kommentare (0)