Tech billionaire Mark Cuban calls on regulatory authorities for crypto taxes

Tech billionaire Mark Cuban calls on regulatory authorities for crypto taxes

- Mark Cuban compares the closure of crypto with the closure of e-commerce in 1995.

- he called on the lack of understanding of the supervisory authorities.

There was a lot of drama about the US infrastructure and the associated introduction of crypto taxes. The billion-dollar investor and entrepreneur Mark Cuban recently acted against the supervisory authorities because they switched off the crypto growth machine.

He also noted that the ban on cryptocurrencies would be the same as the ban on e-commerce in 1995. Cuban made this statement last weekend during an interview with Washington Post. He draws a parallel between the growth of crypto and the growth of the internet said :

The switching off of this growth engine would be synonymous with the stopping of e-commerce in 1995 because people were afraid of credit card fraud. Or to regulate the creation of websites because some people initially thought they were complicated and did not know what they would ever mean.

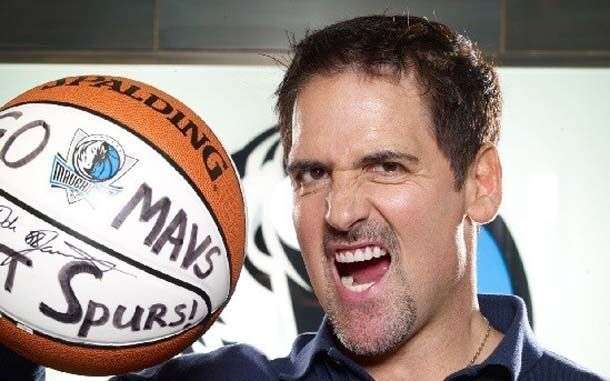

The owner of the Dalla Mavericks, Mark Cuban, is an open advocate of crypto and decentralized financing (Defi). He has invested strongly in some of the popular and upcoming blockchain projects such as polygon.

The Dallas Mavericks itself accept crypto payments via Bitcoin (BTC), Ethereum (Eth) and Dogecoin (Doge). Cuban is one of the recent prominent personalities who have joined criticism of the US infrastructure law.

The unclear language of the draft law, which is supposed to include several crypto stakeholders, has also not been well received by the crypto community.

The controversial US infrastructure law

The US infrastructure law of $ 1 trillion brings new rules for the reporting of crypto transactions to the IRS. The taxation of crypto transactions is to achieve additional income of $ 28 billion. The draft law finds that "brokers" have to provide information about the transfer of digital assets.

However, the crypto industry has pushed back the unclear use of the term "broker". This means that several interest groups, including miners, lenders, stakers, etc., are part of the tax reporting.

This will continue to force crypto companies and players who work in this area to collect more user information. Several legislators and other well -known personalities have also raised objections to the bill. In a series of tweets from last Sunday, Twitter and Square CEO Jack Dorsey wrote

The Americans who develop software and hardware, reduce and secure the network or operate the nodes to build up resistance and efficiency, impose reporting rules, is an impossible task that will only drive the development and operation of this critical technology outside the USA. If we cannot delete the entire provision so that we can carry out adequate hearings and consultations, we simplify the definition of broker to the essentials: where digital assets are exchanged for Fiat currency. The democratic Senator Ron Wyden and the Republican Senators Pat Toomey and Cynthia Lummis have made their proposal to take out miners from the law.

Source: Crypto-news-flash.com